After EVA and POE, another new photovoltaic material is developing rapidly, and the market size will be 30 billion in 2023!

The development of photovoltaics has brought great opportunities for the development of chemicals and new materials industries.

However, N-type TOPCon and heterojunction cells are more sensitive to water vapor, and POE or EPE films with better water vapor barrier properties are popular, which has led to a substantial increase in the demand for POE. It is estimated that the global PV POE demand will reach 410,000 in 2023 Ton. China still needs to import a large amount of EVA and POE, and domestic chemical companies are actively deploying production capacity.

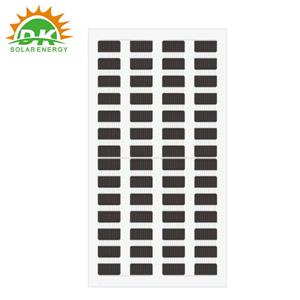

In addition to EVA and POE, another photovoltaic new material has attracted people's attention. Metallization is a key step in the production of crystalline silicon solar cells. Metallized electrodes are prepared on the front and back of silicon wafers by means of conductive paste screen printing and sintering, so as to guide photogenerated carriers out of the cell.

Slurry is composed of conductive phase, binder and organic carrier, etc. It is the key material of solar cell metallization process, and has an important impact on the photoelectric conversion efficiency and cost of the cell.

Front silver paste production technology threshold is high, before 2011, the domestic front silver technology has not been a breakthrough;

Until 2016, after several years of technology accumulation, domestic front bank enterprises seized market opportunities and rose rapidly;

In 2017, relying on relatively stable product quality and cost advantages, domestic positive silver companies conquered the second and third line battery factories, and their market share gradually increased;

In 2018, as the performance and quality of domestic front silver products continued to improve, some leading domestic front silver companies already had customers from first-line battery manufacturers;

By 2023, domestic front silver will occupy a major position in photovoltaic paste.

According to CPIA data, in 2022, China's solar cell production will be about 318GW, and it is expected that the national solar cell production will exceed 477GW in 2023, a year-on-year increase of 50%.

According to ASIACHEM research, including PERC front silver, PERC back silver, TOPCon battery double-sided silver (aluminum) paste, XBC silver paste and heterojunction low-temperature silver paste, China's photovoltaic silver paste consumption will reach 5343 in 2023 tons, the market size is about 30 billion yuan.

PERC will still be the mainstream technology for solar cells in 2023. Chinese photovoltaic companies will continue to mass-produce PERC cells with specifications of 182 and 210 in 2023. Large-size silicon wafer cells also put forward higher requirements for screen printing and metallization processes.

The advanced front-side silver paste is optimized by adapting to selective emitters and realizing ultra-fine line printing. It is expected that in 2023, it will help the industry-wide mass production of P-type monocrystalline PERC cells with an average efficiency of more than 23.5%.

Heterojunction and TOPCon are the next-generation mass-produced battery technologies with the most development potential.

The current unit consumption of silver paste for these two battery technologies is higher than that of PERC batteries. How to continuously reduce the consumption of silver paste The key to battery cost reduction.

ASIACHEM predicts that the output of heterojunction and TOPCon cells in 2023 will increase significantly compared with 2022, and the corresponding market size of heterojunction silver paste and TOPCon silver paste will reach 902 tons in total.Cost reduction and efficiency increase are the constant theme in the development of photovoltaic industry.For cell metallization, it is mainly reflected in improving slurry performance and reducing slurry consumption.

On the one hand, paste companies need to keep up with the special needs of high-efficiency batteries that are constantly updated and iterated to design new pastes to help battery efficiency breakthroughs;

The process of industrialization effectively reduces the unit consumption of crystalline silicon cell slurry.

ASIACHEM predicts that from 2023 to 2025, the scale of the global photovoltaic market will continue to expand, which will continue to drive the demand for solar cell conductive paste.